Less Red Tape,

More Green Lights.

1-4 Units DSCR Rental Loans

30 year loan for purchase or refinance of 1-4 unit properties

5-10 Units DSCR Rental Loans

30 year loan for purchase or refinance of multifamily or mixed-use properties

Fix & Flip Loans

Short term Fix & Flip financing for purchasing and rehabbing 1-4 units, Mixed-use and multifamily units

Bridge Loans

Short Term loans for stabilized or value add properties. 1-4, multifamily and mixed-use properties

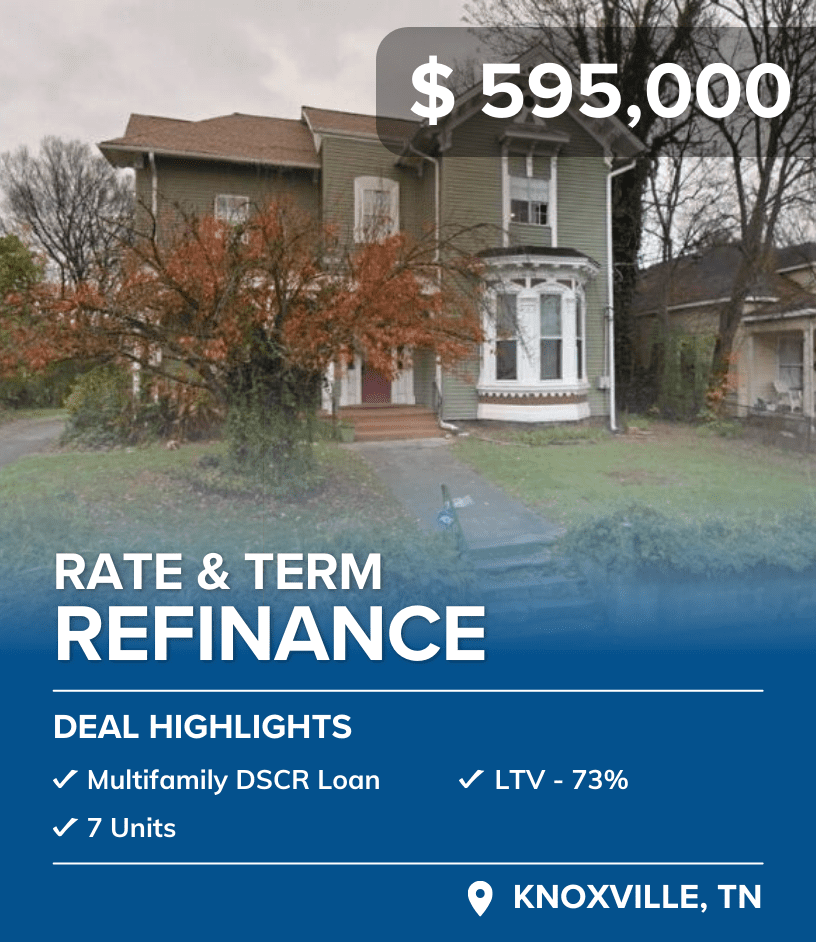

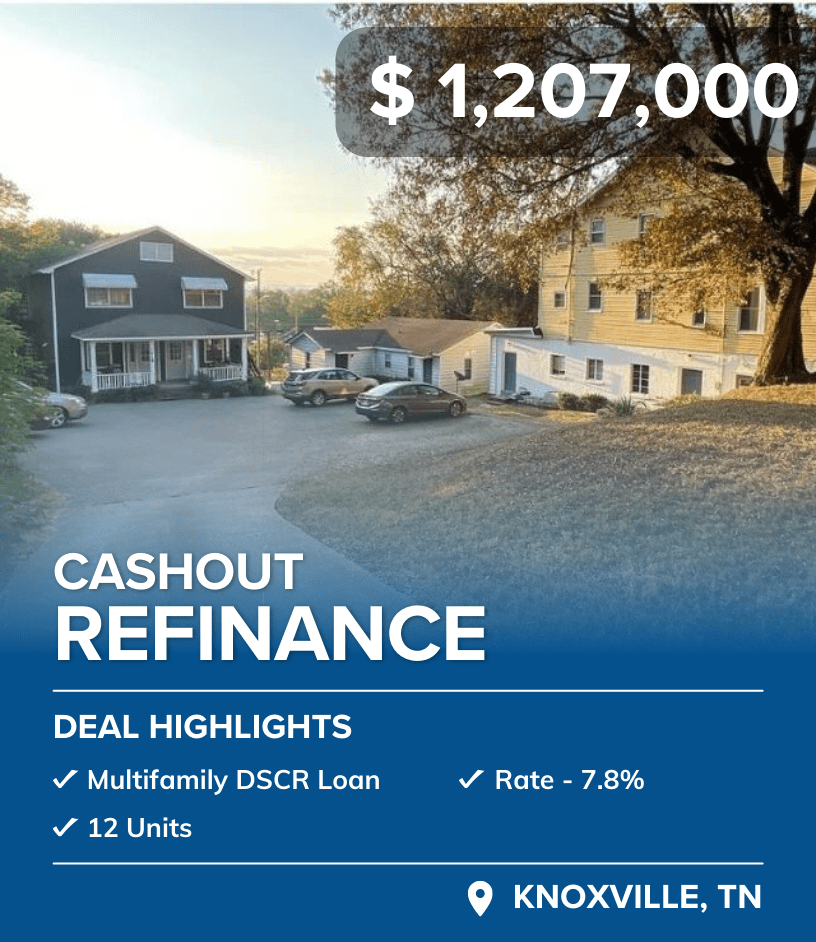

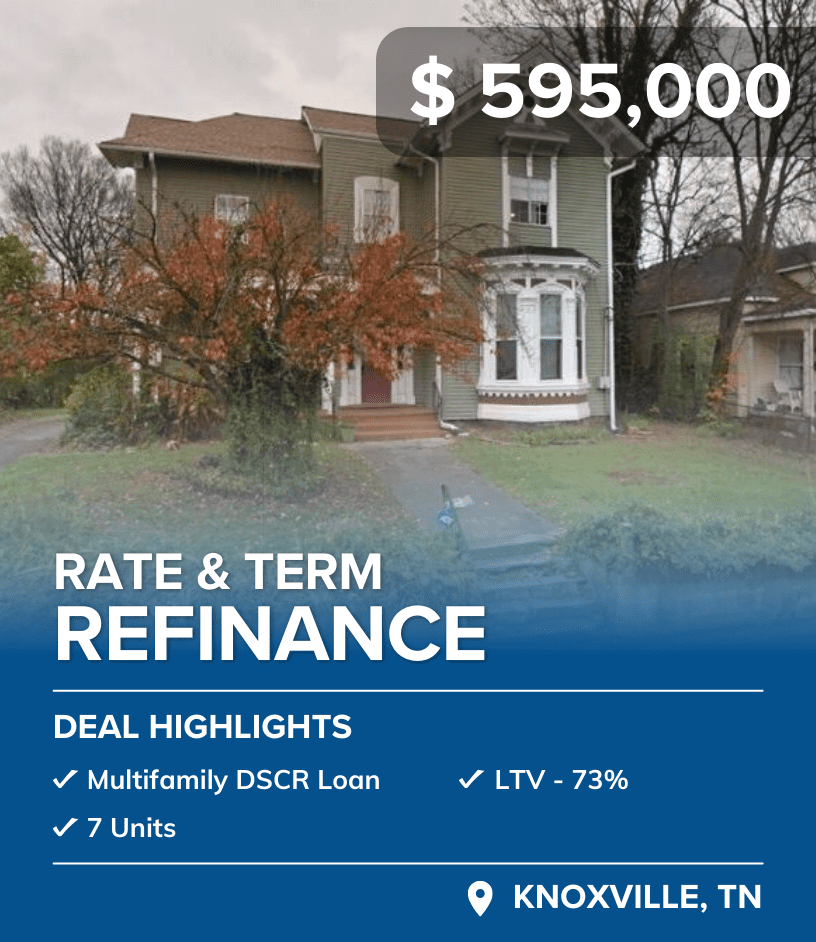

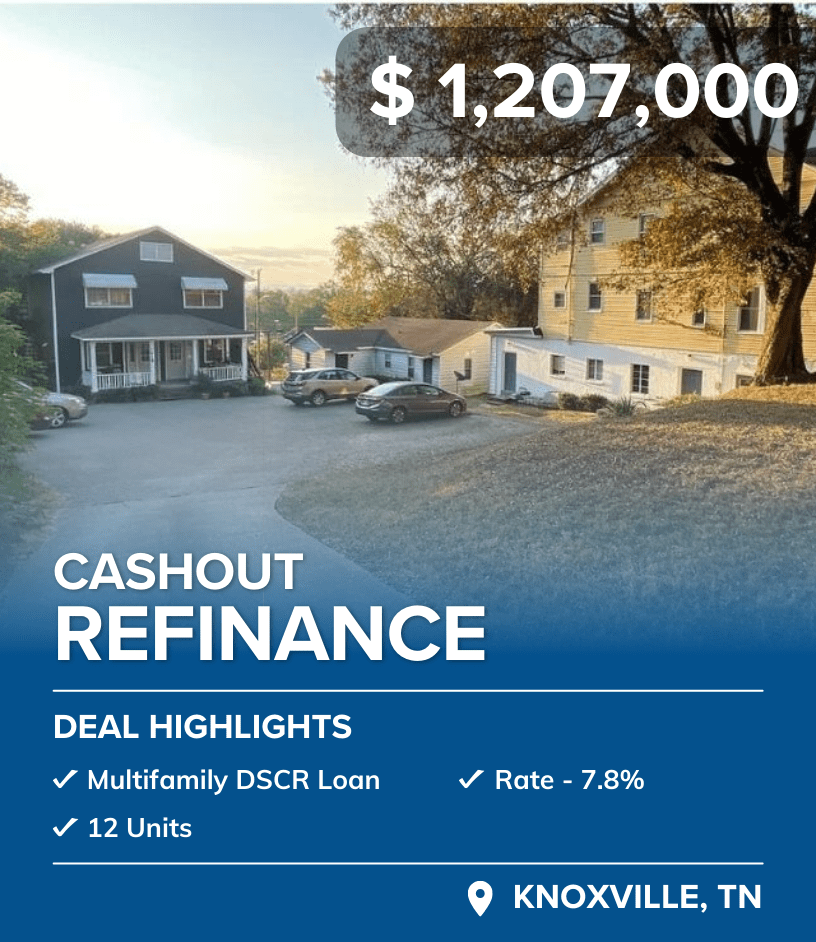

Our Recent Transactions

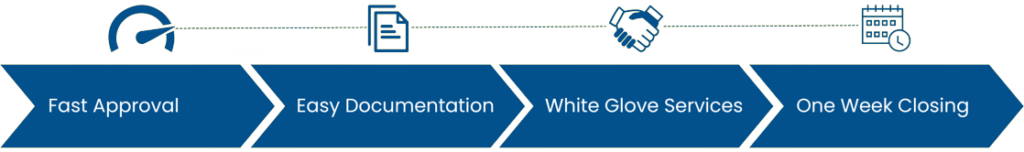

QUICK LOAN PROCESS

Common sense underwriting

with in-house approvals

Preapproval within 24 hrs

Easy Documentation

White Glove Services

1 Week Closing

Customers Testimonials

What client say about us.

They are my Go To Lender!

I’ve always been nervous when applying for my construction draws but with their process and transparency, I can put full focus on my project and feel secure that my capital is ready when I need it.

Their team, their portal, their transparency, their process, and their commitment are refreshing. I’ve never had such an enjoyable experience with my lender as I did with Salman Capital Funding.

I’ve enjoyed my experience so much that I’ve recommended them to my entire family and community!

I applied and got my funding the same week!

This lender understands real-estate. We need to close in less than 48 hrs. and Salman Capital Funding made it happen!

We had a portfolio of 14 properties that all needed a DSCR loan. I was ready for a nightmare to get a loan on these, but working with Salman Capital Funding the process was super smooth and now we’re working on the next deal!

I must share my experience with the incredible work and expertise I have witnessed on our first loan of many.

I have come across a staff who is very knowledgeable and a pleasure to work with.

The transparent outlook and effort throughout the loan process is unprecedented. The work is invaluable to us and has earned much admiration in our team. We feel honored working with the entire Salman Capital team, and look forward to a long lasting, fruitful relationship in the future.

Frequently Asked Questions

We're not confined to a 'BOX'

- We are a family company and we own over 1 million sq. ft. of real estate properties. Therefore we are the borrower so we know what it’s like to be a borrower.

- We are not confined to a box.

- We understand your properties and think like the investor.

- We use our own capital and do not need a credit committee/investors to approve your loan.

With Salman Capital Funding’s highly experienced team, we ensure that the loan application process is both fast and simple. Once you submit your loan application, we tailor a customized document checklist that aligns with the specific attributes of your loan.

You will gain convenient access to our Borrower Portal, a user-friendly platform that keeps you informed about the exact documents needed before we kickstart the loan process. This means you can navigate the documentation phase with confidence, making the journey toward securing your real estate loan with us as easy and stress-free as possible.

Typically, our loan approval process can be as swift as 24 hours, providing you with a Letter of Intent (LOI) that outlines all the terms of your loan. Once your loan application is onboarded, you’ll find our document collection process to be straightforward and hassle-free. After this stage, your loan will proceed to underwriting.

In most cases, loans are funded within just 7 days from the initial application submission, allowing you to access the funds you need, even when you’re under a TOE ‘time of the essence’ situation. This means you can meet tight deadlines and avoid the risk of losing your deal.

We are a private lender, specializing in hard money lending, and we offer a variety of no-documentation loans tailored to your needs.

Our financing options include:

- Short Bridge Loans: Ideal for short-term financing needs.

- 100% Construction Loans: Providing full funding for your construction projects.

- Fix and Flip Loans: Designed for real estate investors looking to purchase, renovate, and sell properties.

- Long-Term 30-Year Fixed Loans: Offering stability with extended loan terms.

- DSCR Loans: Suitable for financing income-producing properties.

We extend these loan options for 1-4, multifamily, and mixed-use properties. Our goal is to provide flexible financing solutions to meet your real estate investment objectives.

We are a ‘No Doc Lender,’ which means we have a streamlined approach to documentation. We do not require proof of the borrower’s personal income. Our focus is on making the financing process as convenient and efficient as possible, so you won’t need to provide extensive income documentation typically requested by traditional lenders.

While we simplify the documentation process, we may still require specific information related to the property and the loan, so it’s best to connect with our team to get a comprehensive list of the necessary documents for your specific loan.